The use of the term “reputation risk” follows the usual pattern of hyped buzzwords in management concepts, but the significant volume of money now spent managing corporate reputation risks proves it is more than just hype. The effect of reputation dynamics on corporate value is forcing deeper analysis of how it ties into pivotal strategic and operational business decision making.

For instance, Penn State increased its acceptance rate to offset a decline in out-of-state applications and an expected drop in the matriculation rate due to the Sandusky scandal. Deutsche Bank’s CEO Josef Ackerman refused three-year loans from the European Central Bank concerned it would damage the bank’s reputation with customers.

While risk managers have historically viewed reputation as a consequence or a secondary risk triggered by other risk events, it has become a core concern for enterprise risk management strategies and good corporate decision making.

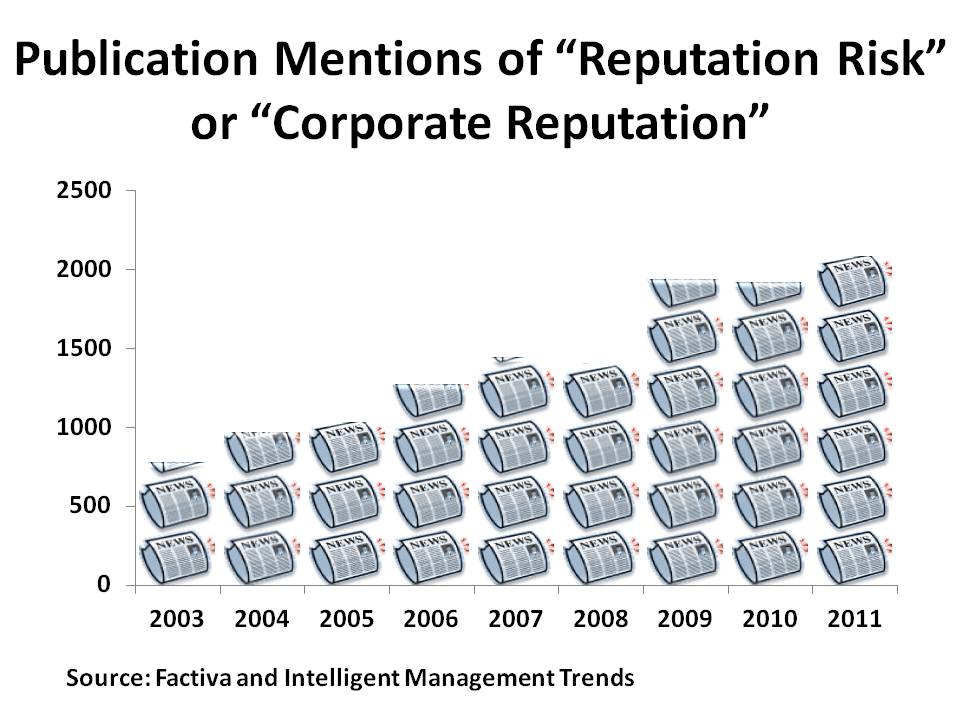

The digitized Google Books database reveals authors have written about business reputation since the 1830s, but the term “reputation risk” first appeared in 1988 and its use quickly accelerated. From 2003 through 2011, Factiva’s database reveals the use of the terms “reputation risk” and “corporate reputation” in print and online news publications expanded at a compounded annual growth rate of 13%.

My skepticism as an industry analyst heightens when terms are hyped to this extent, but the alignment of actual market supply and demand in this case justifies reputation as a vital category in any risk taxonomy used to define the risk management marketplace.

Market Dynamics Quickly React to Reputation Risk Concerns

On the supply side, hundreds of public relations firms, crisis management consultants, and business consultants now promise to help corporations manage, protect, and recover their reputations. Social media launched another wave of suppliers with online reputation software vendors and consultants positioned to help monitor and manage reputation in the cyber world.

On the market demand side, executive perception of reputation risk is evolving quickly. Here are some facts to consider:

- A 2005 EIU survey showed 52% of senior risk managers believed reputation deserved to be a unique segment of corporate risk categories with its potential effect on organizational value far surpassing natural disasters, regulatory, human capital, information technology, and market risks.

- The 950 worldwide business executives participating in the 2007 Weber Shandwick Safeguarding Reputation survey considered 63% of their company’s market value on average to be attributable to reputation.

- A 2011 Zurich-sponsored HBR study found 50% of the 1,419 business executives surveyed identified corporate brand reputation as the risk that has risen most significantly in the past 3 years.

- The 2011 EisnerAmper Board of Directors Survey of 142 corporate board members revealed reputational risk tops all concerns for business risks for 69% of U.S. boards.

- Steel City Re highlights 30% of the S&P500 members identified reputation risk as material to their enterprise value in their 2010 10K report. In 2011, this percentage rose to 57%.

Does the reputation rhetoric on both the supply and demand sides constitute a vital market for corporate risk management? IMT is analyzing total spending on risk reputation services and software products. Initial analysis indicates it crosses our threshold of $5 billion with rising demand to define a sustainable long-term market segment.

An Opportunity for Insurance Industry Innovation

Insurance companies have taken notice of these market trends. Phil Ellis, chief executive of Willis’ Global Solutions Consulting Group, observes 95% of major corporations suffered at least one major reputational crisis in the last 20 years, but less than 10% of these events were insurable. Ellis notes the insurance industry needs innovative products to meet this challenge.

Three insurance companies launched such products in October 2011:

- Aon’s reputational risk insurance, underwritten by Zurich Financial Services, provides up to $100 million in limits of coverage triggered by nineteen named perils combined with financial loss and adverse publicity.

- Willis rejected the peril-based criteria and is developing products by industry sector, starting with Hotel Reputation Protection.

- Chartis is taking a more general stand-alone, no named peril, approach with Chartis ReputationGuard.

One common element to these offerings is access to leading global public relations firms for both preventative work and crisis support. Cue the race for every PR firm to align with insurance providers to expand their sales channel for these emerging offering.

As an industry analyst, I must recognize (albeit with some reluctance) that demand and supply side factors justify defining reputation risk as a core category for enterprise risks. Is this elevation of reputation justified in the eyes of risk managers and risk consultants? Is your crisis response plan the primary vehicle for managing your reputation risks or do you manage reputation proactively as a core integrated risk as part of your corporate culture and decision-making processes? What makes one company ignore reputation risks while another invests in extensive reputation monitoring and purchases multi-million-dollar reputation insurance coverage?

Corporate executives, risk managers, insurance companies, public relations firms, and reputation monitoring services companies all have significant questions to answer in order to clarify these risk management concepts. Social media and the rising activist tide indicate organizational reputation will be a central risk concern moving forward.

For more analysis of risk source categories and enterprise risk management vendor dynamics, access IMT's report "Enterprise Risk Management Market Taxonomy." This report provides a holistic view of the categories of enterprise risks, risk management resources, and risk management vendors that define the risk management marketplace.